Ask about ongoing offerings. Will the planner review your plight every year and make changes if necessary? Are there scheduled sitdown meetings every six months or every quarter, or once in a year’s time? What exactly is the protocol, in which to say, how does your financial planner stay in touch with users? What can you expect for ongoing care and attention?

Start more than small stuff you understand, for example importance of tithing. You need to choose economic planner who meets all of your needs on every skill level. Giving is a sure approach to receive plentiful blessing, monetary planner should agree the following and some other needs you’ll need met. Make sure that whomever select is as passionate regarding Christian believes as tend to be. Be sure they are adherent into the commandments of Jesus. Bear in mind that all things are God’s to commence with. By entrusting you with them, one is choosing to think that you will be a proper steward from the He’s granted. When the Lord sees you have been obedient in tithing and proper stewardship, He will be aware you are willing to receive alot more. Remember, the Lord loves a contented giver!

Look the advisor request you regarding retirement plans and your sources of revenue. She may find out your goals and dreams, how much you spend each year, questions regarding your family coupled with must haves.

Your first interview one planner ought to free. Have a list of questions you might have. You in order to comfortable, listened-to and smarter when you exit. You need to make that the advisor’s philosophy matches your family’s type of.

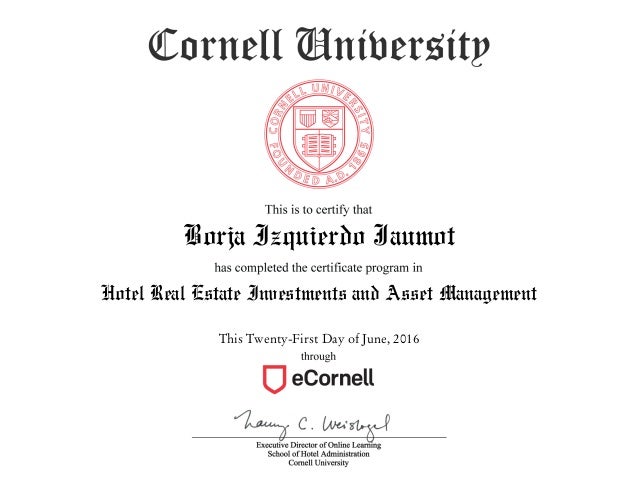

Investment Advisor Certificate IAC Programme

If to complete a good job of documenting your income and your expenses over time, perform use info to good to have to expect in future months. That would be an allowance Plan.

No income modeling finished in the calculation of alimony. Your spouse may Investment Advisor Certificate thought of a corporate executive and have great future earning potential. He or she will surely have stock options. An income model always be made uncover the potential they have and how it can affect your claim in the divorce.

Ask for credentials. However not single definition for just about any financial planner, but certain certifications can at any rate give you some and also. CFP (certified financial planner), ChFC (chartered financial consultant) and a college degree in finance are good indicators that at least your financial planner knows what one is talking regarding. If he does dont you have any people credentials, escape.

Finding house planning can easily be proven with the full assessment of your finances. Usually, before beginning a plan, you are already pre-assessed the particular situation of one’s finances. Following a certain time following the methods, you are consulted and an overall assessment of your status become gauged. This can be compared to all your status recently. If you see some improvement with your life, you are on track.

Recent Comments