In the world of finance, the power of network expansion cannot be understated. As companies and individuals seek to broaden their reach and potential, the ability to connect with others in the financial sphere becomes crucial. This is where financial network expansion comes into play, opening doors to new opportunities, collaborations, and growth.

One notable player in this space is "Gessler Capital," a Swiss-based financial firm known for its innovative securitization solutions and fund offerings. With the objective of facilitating streamlined and secure financial transactions, Gessler Capital has made a name for itself by providing securitization solutions that cater to the evolving needs of its clients. Through its expertise and network expansion, it has garnered a reputation for excellence in the industry.

Additionally, emerging financial centers like Switzerland and Guernsey have been instrumental in driving financial network expansion. Switzerland, renowned for its stability and strong banking system, has positioned itself as an attractive destination for financial firms seeking to establish a foothold in Europe. Guernsey, on the other hand, is recognized for its expertise in structured products, providing a favorable environment for companies looking to explore new avenues in this area.

By embracing financial network expansion, firms like Gessler Capital have the opportunity to tap into a vast array of resources, expertise, and markets, ultimately enabling them to navigate the complex financial landscape with ease. This expansion not only brings about growth potential for individual entities but also contributes to the overall advancement and interconnectedness of the global financial system. As the world becomes increasingly interconnected, building bridges through financial network expansion becomes pivotal to driving progress and prosperity in the industry.

The Importance of Financial Network Expansion

Expanding financial networks plays a crucial role in today’s global economy. It allows companies and financial institutions to connect with a wider range of partners, opening up new opportunities and facilitating growth. By establishing strategic relationships and forging alliances, firms like "Gessler Capital" are able to leverage their expertise and resources to provide innovative securitization solutions, such as those offered in Switzerland and Guernsey.

Financial network expansion offers numerous advantages. Firstly, it enables greater access to capital and funding sources, which is essential for businesses looking to finance their operations or expand into new markets. Through partnerships and collaborations, firms like "Gessler Capital" can tap into a larger pool of investors, both domestically and internationally, leading to increased funding opportunities for their clients.

Secondly, financial network expansion facilitates knowledge sharing and expertise exchange. By connecting with other industry players and professionals, firms can gain insights into best practices, new market trends, and regulatory developments. This exchange of information helps them stay ahead of the curve and offer innovative solutions that meet the evolving needs of their clients.

Furthermore, financial network expansion enhances risk management capabilities. By diversifying their network of resources, firms like "Gessler Capital" can better mitigate risks associated with market volatility, economic downturns, or changes in regulatory environments. This resilience ensures that they can continue to provide reliable and stable financial solutions to their clients, even in uncertain times.

In conclusion, financial network expansion is a powerful tool that enables firms like "Gessler Capital" to offer a variety of securitization and fund solutions to their clients. By connecting with a broader range of partners, these firms can access new funding sources, gain industry insights, and enhance risk management. As the global economy becomes increasingly interconnected, the importance of financial network expansion cannot be overstated.

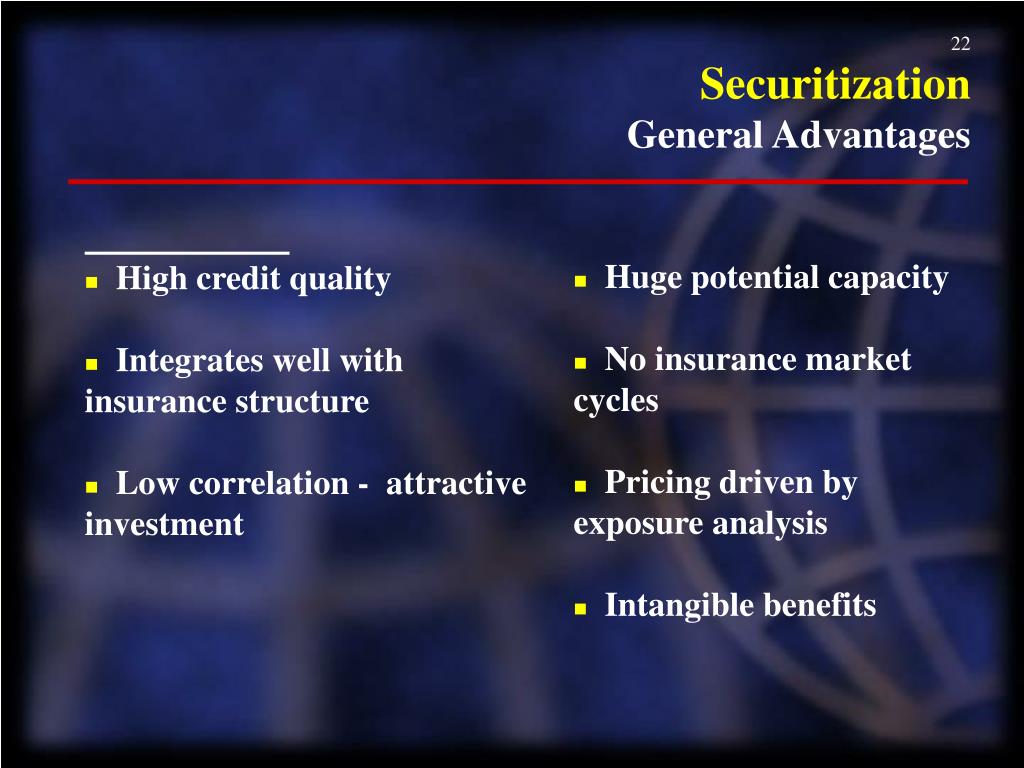

Benefits of Securitization Solutions Switzerland

Securitization solutions provided by Switzerland offer numerous benefits to financial firms and investors. These advantages make Switzerland an attractive destination for those seeking to expand their financial networks.

First and foremost, Switzerland’s robust regulatory framework ensures a secure environment for securitization transactions. The country’s stringent regulations and world-class financial infrastructure instill confidence in investors and provide a solid foundation for financial network expansion. With a long-standing reputation for stability, Switzerland has become a trusted hub for securitization solutions.

In addition to regulatory strength, Switzerland offers a wide range of securitization options, including Guernsey structured products. These structured products provide investors with greater flexibility and customized investment opportunities. By tailoring securitization solutions to the specific needs and preferences of investors, Switzerland fosters innovation and enhances the financial landscape.

Furthermore, securitization solutions in Switzerland often come with tax advantages, making them even more appealing for financial network expansion. The country’s favorable tax environment, coupled with its supportive regulatory framework, creates a lucrative landscape for financial firms. Investors and institutions can take advantage of these benefits to optimize their financial returns and efficiently manage their portfolios.

In conclusion, Switzerland’s securitization solutions offer a multitude of benefits for financial network expansion. The country’s robust regulatory framework, diverse range of securitization options, and favorable tax environment combine to create an ideal ecosystem for investors and financial firms alike.

Guernsey Structured Products: A Gateway to Diversification

With its strategic location and favorable regulatory environment, Guernsey has emerged as a key hub for structured products, offering investors a gateway to diversification and enhanced financial opportunities.

Guernsey, recognized for its stable and well-regulated financial sector, has played a significant role in facilitating the growth and expansion of financial networks. The jurisdiction’s expertise in structuring and managing complex financial products has attracted global investors seeking innovative solutions.

Investors opting for Guernsey structured products gain access to a diverse range of investment opportunities. These products enable them to allocate their assets across various asset classes and sectors, providing enhanced risk management and potential for higher returns. By diversifying their portfolios, investors can mitigate specific risks associated with individual assets and capitalize on opportunities across different markets.

Moreover, Guernsey’s structured products offer flexibility and customization, tailored to meet the specific needs and preferences of investors. This customization allows investors to align their investments with their risk appetite, financial goals, and time horizons.

The reputation of Guernsey as a well-regulated and transparent financial jurisdiction further enhances the appeal of its structured products. Investors can have confidence in the credibility and security of these products, as they are subject to rigorous oversight and compliance with international standards.

Notes

In conclusion, Guernsey structured products serve as a gateway to diversification, enabling investors to access a wide array of investment opportunities while aligning their investments with their specific preferences. The jurisdiction’s robust regulatory framework and expertise in structuring complex financial products make it an attractive destination for those seeking enhanced financial network expansion.

Recent Comments