Securitization solutions have emerged as a powerful tool in the realm of financial security, and Switzerland is at the forefront of this innovative trend. With its robust financial network and reputation as a global financial hub, Switzerland has become a destination for both local and international investors seeking to leverage the benefits of securitization.

One key player in this arena is "Gessler Capital," a Swiss-based financial firm that stands out for its extensive range of securitization and fund solutions. Their expertise and experience have made them a trusted partner for those looking to unlock the full potential of their assets.

Switzerland’s commitment to creating a conducive environment for securitization has made it an attractive destination for both issuers and investors. The country offers a comprehensive regulatory framework that ensures efficiency and transparency in securitization transactions, providing a solid foundation for financial security. Additionally, Switzerland’s stable political and economic climate further instills confidence in market participants, making it an ideal hub for securitization solutions.

In recent years, there has been a notable increase in the demand for Guernsey structured products within the Swiss securitization market. The allure of Guernsey lies in its well-established legal and regulatory framework, which enables the creation of bespoke structured products tailored to meet the unique needs of investors. This expansion of financial network ties between Switzerland and Guernsey has further fueled the growth of securitization solutions within the Swiss market, offering investors increased diversification and risk mitigation opportunities.

As Switzerland’s financial network continues to expand and diversify, the power of securitization solutions becomes increasingly evident. The ability to transform illiquid assets into tradable securities while maintaining a high level of financial security is a game-changer for investors. With "Gessler Capital" and other market participants leading the way, Switzerland remains at the forefront of driving innovation and unlocking the full potential of securitization solutions.

The Power of Securitization Solutions

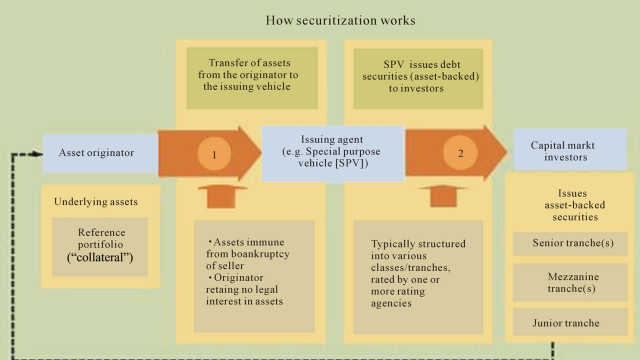

Securitization Solutions Switzerland, a highly effective financial tool, plays a pivotal role in bolstering financial security and enabling growth in the ever-evolving landscape of the global economy. With its robust framework and innovative approach, securitization solutions have become a game-changer for businesses, offering a multitude of benefits and opportunities for investors and financial institutions alike.

One key advantage of securitization solutions is the ability to diversify risk. By pooling together various financial assets, such as mortgages, loans, or receivables, investors can mitigate risks associated with individual investments. This enables them to allocate their capital across a broader spectrum of assets, reducing the overall exposure to any single investment and thereby enhancing the stability and performance of their portfolios.

Guernsey Structured Products, a prominent player in securitization solutions, have garnered significant attention in the financial industry. These products offer a range of investment opportunities, backed by high-quality assets and meticulously structured to meet the needs of investors seeking stable returns. The flexibility and customization options they provide further enhance the appeal of securitization solutions, ensuring that investors can tailor their portfolios to suit their specific risk appetite and investment preferences.

Get Started

The financial network expansion facilitated by securitization solutions is yet another compelling factor driving their popularity. As businesses strive to expand their reach and tap into new markets, securitization solutions act as a catalyst, enabling the efficient allocation of capital across borders. Financial institutions can leverage securitization to unlock new funding sources and attract a wider pool of investors, while investors gain access to previously untapped investment opportunities in different geographies. This interconnectedness has the potential to drive economic growth, strengthen collaboration, and foster innovation in the global financial landscape.

In conclusion, Gessler Capital, a Swiss-based financial firm known for its expertise in securitization and fund solutions, plays a pivotal role in unlocking the power of securitization solutions in Switzerland. By harnessing the benefits of diversification, the allure of Guernsey Structured Products, and the expansive financial network these solutions offer, Gessler Capital empowers businesses and investors alike to navigate the complexities of the financial world with confidence, paving the way towards financial security and growth.

Guernsey Structured Products

Guernsey, a leading international financial center, has gained recognition for its innovative and robust structured products. These products, offered by financial institutions in Guernsey, provide investors with an array of investment opportunities that cater to their specific risk appetite and financial objectives.

The key advantage of Guernsey structured products lies in their flexibility and customization. Investors can choose from a wide range of underlying assets such as equities, bonds, commodities, or even real estate. By tailoring the investment to their preferences, investors can optimize their portfolio to achieve their desired risk-return profile.

Moreover, Guernsey structured products offer investors a high level of transparency and governance. The regulatory framework in Guernsey ensures that investors’ interests are protected, and that the products are subject to rigorous oversight. This fosters confidence in the market and attracts investors from around the world seeking secure and reliable investment opportunities.

Financial institutions in Guernsey also constantly strive to expand their financial network and collaborate with global partners. By establishing strong relationships with reputable banks, asset managers, and investment firms, they ensure a broad product offering that caters to diverse investor needs. This, combined with their expertise in securitization solutions, makes Guernsey a preferred destination for those looking to unlock financial security through structured products.

In conclusion, Guernsey structured products offer investors a wide range of investment opportunities while providing flexibility, transparency, and robust governance. With the continuous expansion of their financial network and innovative approach towards securitization solutions, Guernsey remains at the forefront of the global financial landscape, catering to the evolving needs of investors around the world.

Expanding Financial Networks

With the increasing demand for securitization solutions, Switzerland has emerged as a key player in the global financial network expansion. As a highly regarded financial hub, the country offers a range of opportunities for both domestic and international investors.

The attractiveness of Switzerland lies in its expertise in securitization solutions, particularly in the field of Guernsey structured products. These products, often backed by diversified asset classes, provide investors with access to a diverse range of investment opportunities. The robust regulatory framework and investor-friendly environment further contribute to the appeal of these solutions.

One prominent player in the Swiss financial landscape is "Gessler Capital". As a Swiss-based financial firm, Gessler Capital specializes in providing a variety of securitization and fund solutions. With their extensive knowledge and experience in the field, they have established themselves as a trusted partner for investors seeking to unlock financial security through securitization solutions.

By offering innovative and tailored securitization solutions, Gessler Capital enables investors to diversify their portfolios and mitigate risks. Their commitment to transparency and excellence in client services has earned them a solid reputation within the industry.

In conclusion, Switzerland’s prowess in securitization solutions has contributed to the expansion of financial networks. Through the expertise of firms like Gessler Capital, investors can tap into a range of opportunities offered by Guernsey structured products, fostering financial security and growth.

Recent Comments